UX Case Study: Empowering Merchants with Frontline Financing

Background:

Frontline, a financing platform developed by LendCare, empowers merchants to offer their own financing solutions seamlessly. By providing merchants with a self-serve online application process, Frontline aimed to revolutionize the financing experience for both merchants and their customers.

Problem Statement:

Traditional financing processes for merchants often involve lengthy paperwork, manual approval processes, and limited flexibility. Frontline identified the need for a solution that enables merchants to provide financing options quickly and efficiently, enhancing customer satisfaction and driving sales.

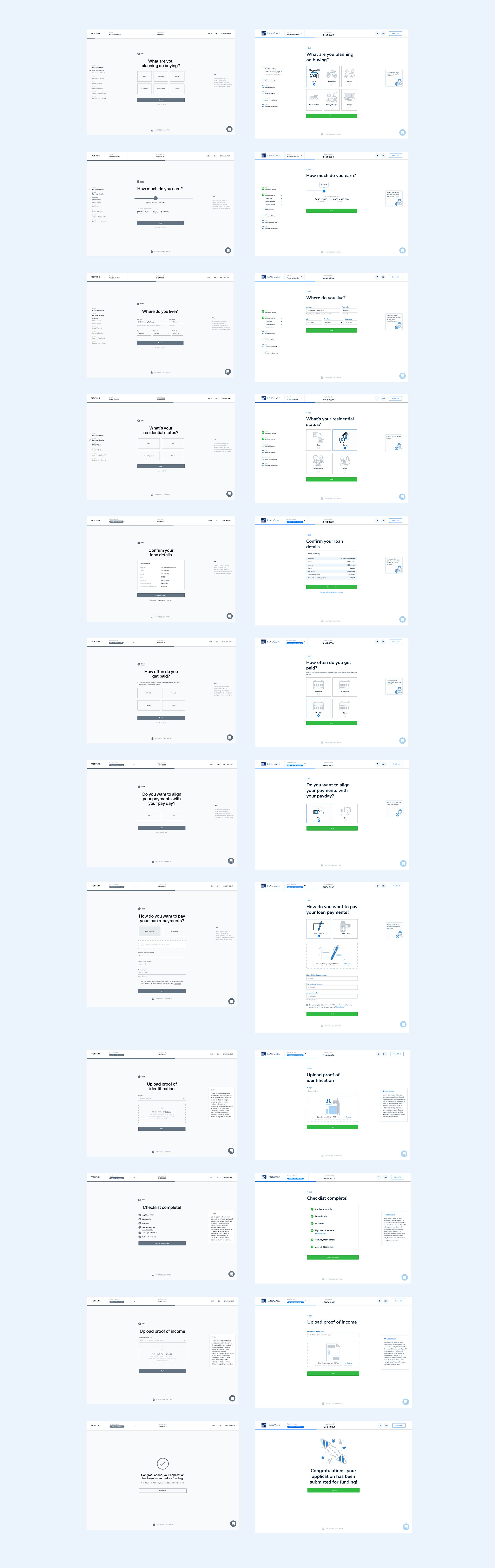

Part 1 - Applicant Portal

The applicant portal was a DIY application experience. Applicants would apply for financing through either the merchant's site, or from a link sent by the sales staff. The process was quite lengthy and therefore broken down into bite-sized chunks so as to not overwhelm the user.

Research:

User Interviews: Engaged with merchants to understand pain points and challenges in offering financing options to customers.

Market Analysis: Studied existing financing platforms and solutions to identify areas for improvement and innovation.

Competitor Analysis: Analyzed competitor offerings to identify gaps and opportunities for differentiation in the market.

Design Process:

User Persona Development: Created user personas representing merchants of varying sizes and industries to understand their needs, preferences, and pain points.

Wireframing and Prototyping: Developed wireframes and prototypes of the Frontline platform, focusing on intuitive user interfaces, streamlined application processes, and self-service capabilities.

User Testing: Conducted usability testing sessions with merchants to gather feedback on the platform's design, functionality, and user experience.

Iterative Design: Incorporated user feedback to refine the platform's interface, improve usability, and address pain points identified during testing.

Solution:

Frontline offers a user-friendly platform that enables merchants to provide financing options to their customers quickly and easily:

Self-Serve Application Process: Merchants can access the Frontline platform to initiate and manage financing applications for their customers entirely online.

Customizable Financing Programs: Frontline allows merchants to customize financing programs based on their specific needs, including interest rates, payment terms, and eligibility criteria.

Instant Approval: With Frontline, merchants can offer customers instant approval for financing applications, reducing friction and improving the purchasing experience.

Integration Capabilities: Frontline integrates seamlessly with merchants' existing systems and processes, providing a cohesive and efficient financing solution.

Outcome:

Increased Sales: The Frontline platform has enabled merchants to offer financing options to their customers more effectively, leading to increased sales and revenue.

Improved Customer Experience: By streamlining the financing application process and offering instant approval, Frontline has enhanced the overall purchasing experience for customers.

Greater Efficiency: The self-serve nature of the Frontline platform has reduced administrative burden for merchants, allowing them to focus on growing their businesses.

Positive Merchant Feedback: Merchants have praised Frontline for its ease of use, flexibility, and impact on their bottom line.

Part 2 - Merchant Portal

The merchant portal allows sales representatives or merchants to manage their customer applications. They can complete the application process on behalf of the customer, send links for the application process to customers, check on the status of current applications, and get detailed reports of their applications.

Managing the Applicant vs Merchant Portals

It was certainly challenging to balance the design of both sides of the product from a UI perspective. They needed to look vastly different yet similar 🧐. The Merchant Portal obviously had much more information to display and was thea more robust portion of the app while the Applicant Portal was simple and minimalistic with a heavy focus on ease of use. We knew that a wide variety of users would be engaging with the product so (Nick Bollen) conducted diligent user testing sessions to ensure we delivered.

Future Considerations:

Continued refinement and optimization of the Frontline platform based on merchant feedback and emerging trends in the financing industry. Additionally, ongoing collaboration with merchants to identify new features and enhancements that further meet their needs and drive business growth.

Conclusion:

By providing merchants with a user-friendly and customizable financing platform, Frontline has empowered businesses to offer financing options to their customers seamlessly. With its focus on simplicity, flexibility, and efficiency, Frontline is poised to continue driving growth and innovation in the merchant financing space.